Vital Statistics:

| Last | Change | |

| S&P futures | 4,240 | 30.50 |

| Oil (WTI) | 93.49 | 1.53 |

| 10 year government bond yield | 2.76% | |

| 30 year fixed rate mortgage | 5.35% |

Stocks are higher this morning after some more good news on inflation. Bonds and MBS are up.

The producer price index declined 0.5% in July. Yes, declined. The decrease was driven by lower energy prices. Final demand (or in other words, what producers get for their goods / services) fell 1.8%. 80% of this decline was attributable to falling gasoline prices. On a year-over-year basis, final demand rose 9.8%. Both numbers were below expectations.

Final demand ex-food and energy rose 0.2% MOM and 7.6% YOY. Again, both numbers were below Street expectations. While we are seeing relief from energy prices, food is still elevated, rising 1% in July.

Between the CPI yesterday and the PPI today, we have finally had some good news on inflation. This has mainly been driven by falling energy prices. Wages are still rising, and that will ultimately put a floor under how much lower inflation can go.

We had some Fed-Speak yesterday with Neel Kashkari and Charles Evans, both of whom reiterated the Fed’s commitment to decreasing inflation. And don’t forget, real (inflation-adjusted) interest rates are still highly negative. That said, stocks like the news and the front end of the yield curve continues to fall.

The labor market remains strong, with initial jobless claims coming in at 262k. This is a bit more than the prior week, however claims in the mid 200s is considered historically very low.

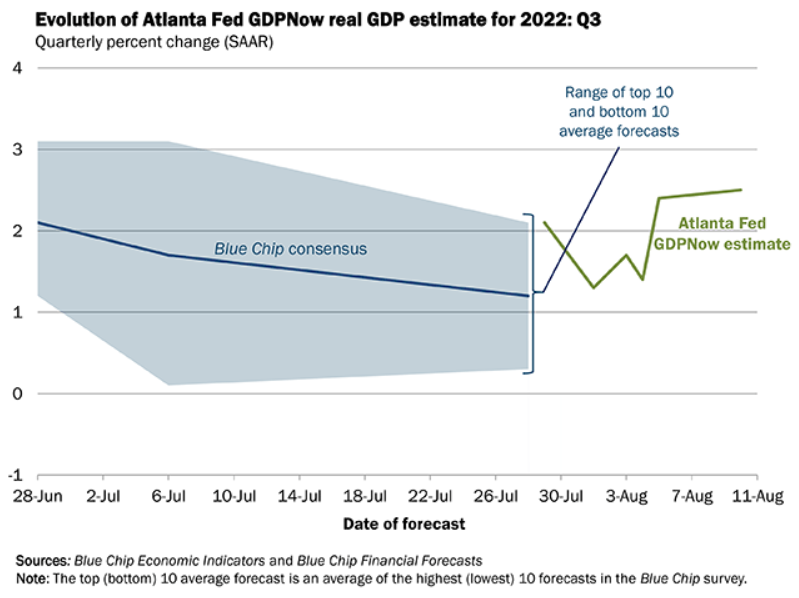

The latest reading from the Atlanta Fed’s GDP Now Index is 2.2% in Q3. This is being driven by a big increase in the expected pace of consumption from 1.8% to 2.7%. We will get a read on consumption when we get the back-to-school shopping numbers in September. BTS is generally a good read on the holiday shopping season.